Using Neural Networks to identify causes and effects

Although risk identification is a fundamental tenet of ISO 31000, from the GFC to Brexit traditional methods have spectacularly failed. Neural Network mapping is the first real technique to actually identify risk drivers and their outcomes.

in this series on Top 10 Disruptive Technologies that will change business as we know it in the 2020s, I covered new approaches decision making (scenario analysis) and monitoring threats (big data inventories), but this is the first of the technologies to provide a proactive management tool.

This week we look at No. 8 – Using Neural Networking to identify and map risk causes and effects.

This Artificial Intelligence (AI) method for classification, provides the capability to identify and link risk drivers and influences to their risk outcomes. In addition, it also can be used in reverse to identify which drivers are relevant to an outcome and which aren’t. The biggest problem is not the science but getting people to accept and adopt this scary leap into the future, as it will profoundly change our approach to risk.

Why the need for Neural Networking

Just as a problem with your liver can affect your eyesight, so too can a problem in the warehouse affect the performance of the credit department. Everything is interconnected.

Recapping from the previous article The Future of Risk Management in the 2020’s, the World Economy Forum’s 2018 Global Risks Report found: “…[we] are much less competent when it comes to dealing with complex risks in the interconnected systems that underpin our world, such as organizations, economies, societies and the environment.”

Further, Oxford fellow Roland Kupers’ article “Resilience in complex organizations” identifies the central issue that: “In a deeply interconnected world, stresses and shocks propagate across systems in ways that evade forecasting. Climate change is linked to the Syrian civil war, which is connected to heightened concern over immigration, which precipitated Brexit.”

Complexity is the single greatest hurdle that must by conquered for effective risk management (see Chaos Theory & C-Level Disillusionment), and Neural Networking is what I believe can transform this.

How the brain works

The human brain does not store information digitally like a computer but in patterns of interconnected neurons of related data. Any new piece of information received by the brain is related to pre-existing information and stored by connecting it into an existing neural network. This is why a smell or music can trigger a memory from the distant past. In essence, it transforms data into knowledge. It’s also why in Training 101 you’re taught to: “Tell them what you’re going to teach them, teach them, then tell them what you taught them”. This is to aid retention by inserting the training material into the student’s appropriate neural network.

What is Neural Networking

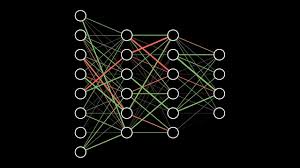

Artificial Neural Networks are a method of artificial intelligence (AI) where relationships between different pieces of data are identified and linked based on relevance, loosely modelled on the human brain. It’s the same technology used by face recognition software or Facebook to recommend friends.

Although the mathematics involved with neural networking is not a trivial matter, a user can easily gain an operational understanding of their function and use. Take facial recognition software. Put simply, it is “taught” to categorize facial characteristics, eye colour, shape, complexion, nose, etc, from a large body of examples and then working backwards from a known outcome (a specific person’s image) breaks it down types (race, age, gender), then into component categories, finally mapping back into the facial characteristics.

A Neural network uses algorithms to identify patterns in existing data to learn ways of classifying purpose and relationships in future data. This requires thousands of elements in a network to make useful classification but how many elements do you have in your existing Risk Registers? Add in controls, risk plans, KRIs, etc. and you most likely already have the required volume of collateral needed to make it work.

Neural networks algorithms learn experientially like humans by comparing the output it produces with known classifications of existing data, and through highly repetitive trials on large batches of existing data, reducing inaccuracy by adding weighting, bias (yes, like risk it has a purpose) and setting thresholds, minimizes differences between calculated and sample outputs until they match. It then saves these pattern algorithms as a model which can be used to identify and classify new data received into the network.

Even with an operational manager’s specialist knowledge, it’s still difficulty to identify and analyse all the complex structures that exist in the modern business environment. Neural Network classification enables this, as well as reducing subjective bias.

But there is still a vital role for management in this process. Like an adolescent who thinks they know it all, even if they continue to learn on their own from new experiences, to truly mature, the models sometimes need a mentor (human input) to keep them on the right path. But resist the urge to simplify the tangled web that results. It would be equivalent to giving the network a lobotomy, and produce what we refer to as bias in human decision making. It is also why Data Governance policies and practices, covered in the previous article, are critical.

Applying Neural Networks in Risk Management

Applying this technology to risk and compliance unleashes insights that allows management to operate from an informed basis instead of just gut-feel. Yes building neural network models requires technical expertise but it can be relatively easily acquired by your existing IT staff.

Even without extending neural networks into predictive modelling for corporate objective outcomes, which we cover later in this series, risk neural networks are still a vital and an intrinsic requirement for identifying complex cause and effects in real world systems. Taking inputs from Big Data and outputting to Scenario Analysis you can have a truly pro-active value-adding risk management system.

Next week I will look at No. 7 – “5 Primary Reasons for the failure of Predictive Analytics”, in more detail.